Roth Ira Income Phase Out 2024

Roth Ira Income Phase Out 2024. If you’ve hit the roth ira contribution limit, you can also consider contributing to a roth 401(k). That means your contribution may be reduced — possibly all the way.

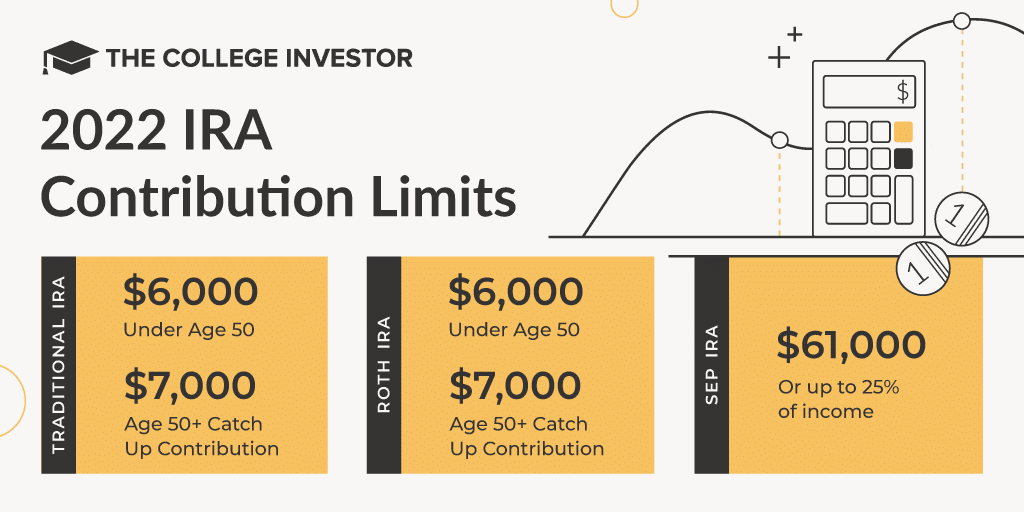

These figures have increased for the 2024 tax year,. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you’re.

Roth Ira Income Phase Out 2024 Images References :

Source: imagetou.com

Source: imagetou.com

Limits For 2024 Roth Ira Image to u, These figures have increased for the 2024 tax year,.

Source: idellbthalia.pages.dev

Source: idellbthalia.pages.dev

2024 Roth Ira Limits Phase Out Minda Fayette, Is your income ok for a roth ira?

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, While anyone can open a roth ira, your income level in 2024 may impact how much you can contribute.

Source: fiannlizzie.pages.dev

Source: fiannlizzie.pages.dev

2024 Roth Ira Limits Aura Margie, Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira.

Source: www.financestrategists.com

Source: www.financestrategists.com

Backdoor Roth IRA Definition, Taxes, & How to Set One up, 2024 roth ira contribution limits and income limits.

Source: bernadettewlotti.pages.dev

Source: bernadettewlotti.pages.dev

2024 Roth Ira Contribution Limits Meara Sibylla, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, You cannot deduct contributions to a roth ira.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, Subtract from the amount in (1):

Source: katabjosefina.pages.dev

Source: katabjosefina.pages.dev

2024 Roth Ira Contribution Limits Phase Out Doria, But the amount you can contribute to a roth ira is phased out at certain levels of income.

Source: vonniykaterina.pages.dev

Source: vonniykaterina.pages.dev

Ira Limits 2024 For Separately Hana Carissa, If you have roth iras,.

Category: 2024