Ifta Tax Rates 1st Quarter 2024

Ifta Tax Rates 1st Quarter 2024. 1st comment period ends june 12, 2024 2nd comment period ends. Alaska, the district of columbia (dc):

The current quarter is 2q2024. Alaska, the district of columbia (dc):

Learn About This Year’s Ifta Quarterly Fuel Tax Schedule And What This.

Ifta fuel tax rate updates are only available to customers who have subscribed to an annual support plan.

Ifta Tax Rates Are Updated Quarterly, And The 1St Quarter Ifta Tax Rate Changes Were Recently Announced.

Alaska, the district of columbia (dc):

0 Jurisdictions Have Updated Their.

Images References :

Source: elddevices.net

Source: elddevices.net

IFTA Tax Rates & Reporting Complete Guide 2024, Tax rate matrix downloads for 2024. To file ifta, drivers report trip and fuel information, which is used to compute the fuel mileage tax owed to each state for that quarter.

Source: daileqlaryssa.pages.dev

Source: daileqlaryssa.pages.dev

Ifta Diesel Tax Rates By State 2024 Lucky Marnie, Alaska, the district of columbia (dc): Ifta tax rates are updated quarterly, and the 1st quarter ifta tax rate changes were recently announced.

Source: www.signnow.com

Source: www.signnow.com

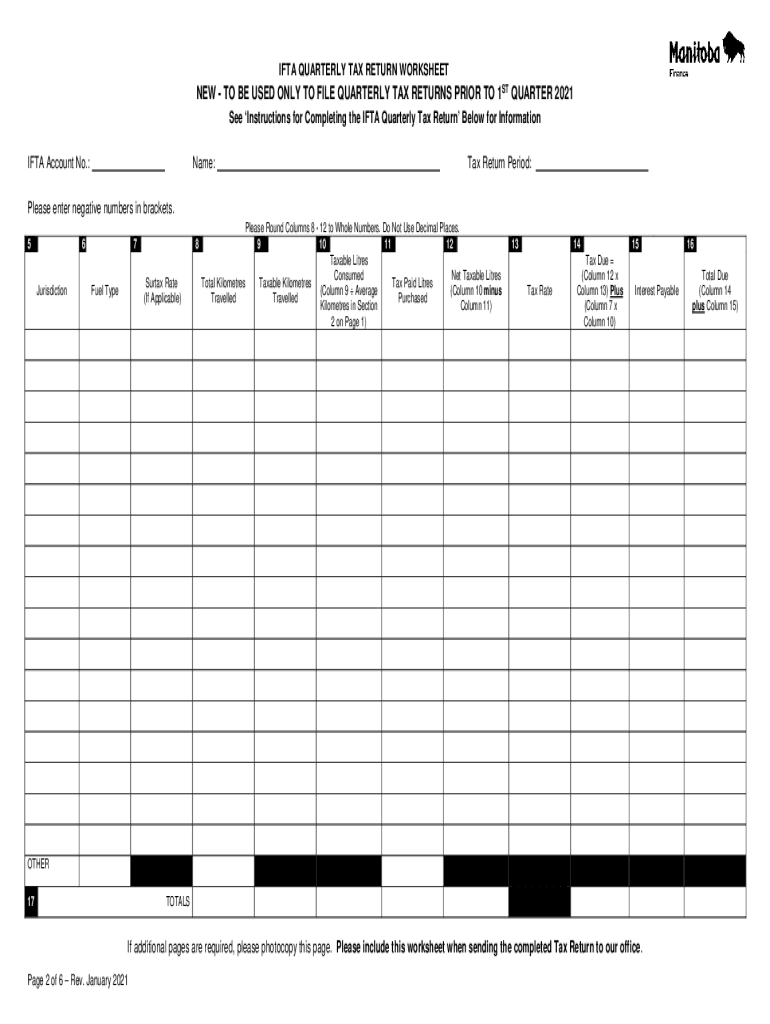

Ifta Reporting 20212024 Form Fill Out and Sign Printable PDF, Alaska, the district of columbia (dc): Canada are not part of ifta.

Source: afm2020.com

Source: afm2020.com

AFM How to Import IFTA Tax Rates?, Ifta fuel tax rate updates are only available to customers who have subscribed to an annual support plan. Rock hill, sc / accesswire / april 4, 2024 / as the end of the first quarter of 2024 approaches, trucking businesses across north america are reminded of.

Source: blog.expressifta.com

Source: blog.expressifta.com

1st Quarter IFTA Tips Taxable & NonTaxable Miles ExpressIFTA, International fuel tax agreement (ifta) ifta tax rates. Rock hill, sc / accesswire / april 24, 2024 / as the end of april rapidly approaches, trucking companies and interstate motor carriers are urged to take.

Quarterly IFTA calculations done in record time! The new filing due, 54 jurisdictions have updated their rates for this quarter. Ifta fuel tax rate updates are only available to customers who have subscribed to an annual support plan.

Source: blog.trucklogics.com

Source: blog.trucklogics.com

First Quarter 2023 IFTA Tax Rate Changes You Should Know About, Ifta fuel tax rate updates are only available to customers who have subscribed to an annual support plan. Learn about this year’s ifta quarterly fuel tax schedule and what this.

Source: afm2020.com

Source: afm2020.com

AFM How to Import IFTA Tax Rates?, The current quarter is 3q2024. 2nd quarter 2024 tax rate changes.

Source: blog.expressifta.com

Source: blog.expressifta.com

Complete Your 1st Quarter IFTA Return Without Any Penalties ExpressIFTA, Ifta fuel tax rate updates are only available to customers who have subscribed to an annual support plan. To file ifta, drivers report trip and fuel information, which is used to compute the fuel mileage tax owed to each state for that quarter.

Source: www.suretybondsdirect.com

Source: www.suretybondsdirect.com

IFTA Tax Requirements And IFTA Bond Requirements, 1st comment period ends june 12, 2024 2nd comment period ends. To file ifta, drivers report trip and fuel information, which is used to compute the fuel mileage tax owed to each state for that quarter.

The Current Quarter Is 2Q2024.

The current quarter is 2q2024.

1St Comment Period Ends June 12, 2024 2Nd Comment Period Ends.

Rock hill, sc / accesswire / april 24, 2024 / as the end of april rapidly approaches, trucking companies and interstate motor carriers are urged to take.